Are You A Rideshare Driver?

Do You Want to save over $100 on tax filing?

Complete Tax Filing for $14.99 – Only with FreeTaxUSA

If you’re a full-time driver you know every dollar counts. And when it comes time to file taxes it can seem like you’re getting the short end of the stick.

But, FreeTaxUSA offers powerful software at a bargain price.

Check out how much different tax companies charge* to file a Federal & State Tax Return as a rideshare driver.

*Prices as of 03/26/2021

| Tax Company | Federal Tax Return | State Tax Return | Total |

|---|---|---|---|

| FreeTaxUSA | $0 | $14.99 | $14.99 |

| TurboTax | $120 | $50 | $170 |

| TaxSlayer | $24.95 | $39.95 | $65 |

| TaxAct | $79.95 | $54.95 | $135 |

Why should you (a rideshare driver) file taxes with FreeTaxUSA?

Your Self-Employed Tax Classification

As a driver for Lyft, Uber, or another rideshare service you are considered an independent contractor, or self employed.

This classification means you’ll get a 1099-K, and a 1099-NEC or a 1099-MISC (sometimes both).

To properly file these forms with your Federal Tax Return you’ll need to file a Schedule C and a Schedule SE.

Companies like TurboTax and TaxAct charge more to file these forms. A lot more.

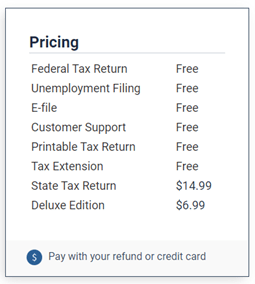

FreeTaxUSA has Transparent Pricing

No surprises and no unexpected upgrades – FreeTaxUSA is simple and to the point.

The Federal Tax Return is 100% FREE.

You couldn’t even pay for it if you wanted to.

Other tax brands will charge more based on the forms you need to file.

Sometimes you don’t even know it’ll cost more to file a tax form until it’s too late.

You’ll Get Powerful Software

Even though the Federal Tax Return is free, the FreeTaxUSA tax software supports all major tax situations.

And if you’re thinking about switching to FreeTaxUSA…

You can Import a PDF of your old tax return

Uploading a PDF of last year’s tax return from TurboTax, H&R Block, and other popular tax software can make switching easier.

Quality Customer Support

Is included for free with FreeTaxUSA through email and secure account messaging. Customer Support typically responds within 30 minutes during business hours.

If you want or need more on-demand help you can upgrade to the Deluxe Edition for only $6.99.

Yes, $6.99, and it includes Live Chat & Priority Support, Unlimited Amendments, and Audit Assist.

Best of all,

FreeTaxUSA is 100% Free To Try

You won’t pay until you file. Try FreeTaxUSA with confidence knowing you can stop at anytime (though we’re pretty sure you’ll love it).

Just a few things to keep in mind when filing as a rideshare driver

You’ll typically get a few 1099 type tax forms

Like a 1099-K and a 1099-NEC, in some cases you’ll also receive a 1099-MISC. A 1099-K reports driving income, a 1099-NEC reports income you earned outside of driving. A 1099-MISC is used to report miscellaneous income.

Because you get these 1099 tax forms from your employer…

You’ll need to file a Schedule C and a Schedule SE

The Schedule C is used to report your business income and losses.

The Schedule SE is used to calculate and report self-employment tax.

Tracking Rideshare Driver Tax Deductions

Can significantly reduce your taxable profits (how much you have to pay taxes on) as a driver. Consider tracking and deducting expenses such as:

- Mileage. Probably the most significant one, make sure your tracking how many miles you’re driving for work.

- The cost of your phone

- Snacks, water, or other treats you provide to passengers

- Tolls and parking fees

- Car loan interest

You might also need to pay Estimated Quarterly Tax Payments

As a self-employed individual, you can’t wait until April 15th to pay your self-employment taxes. You’ll need to pay them throughout the year. If you don’t pay an estimated quarterly tax payment, or you don’t pay enough, the IRS may impose an interest penalty. But don’t worry, FreeTaxUSA can help you with Estimated Quarterly Tax Payments too.